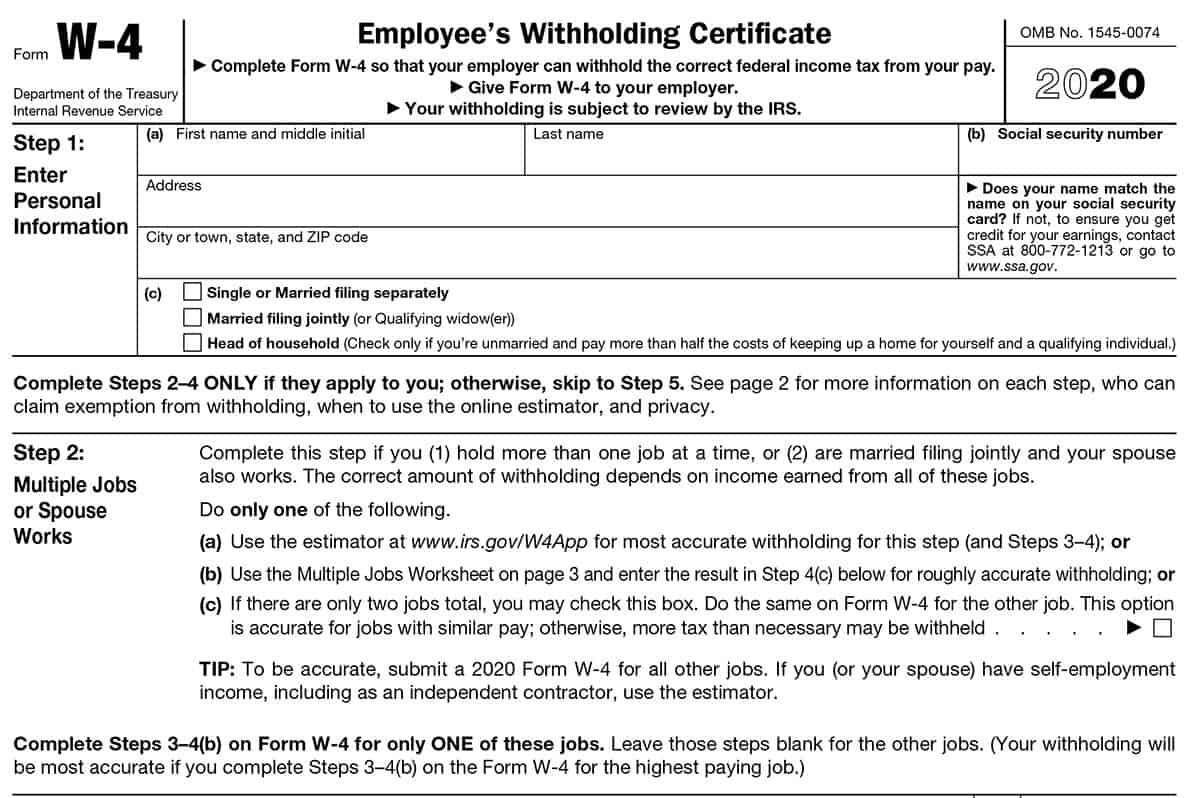

Two earners or multiple jobs. Your withholding usually will be most accurate when all allowances are claimed on the form w 4.

Your withholding usually will be most accurate when all allowances are claimed on the form w 4.

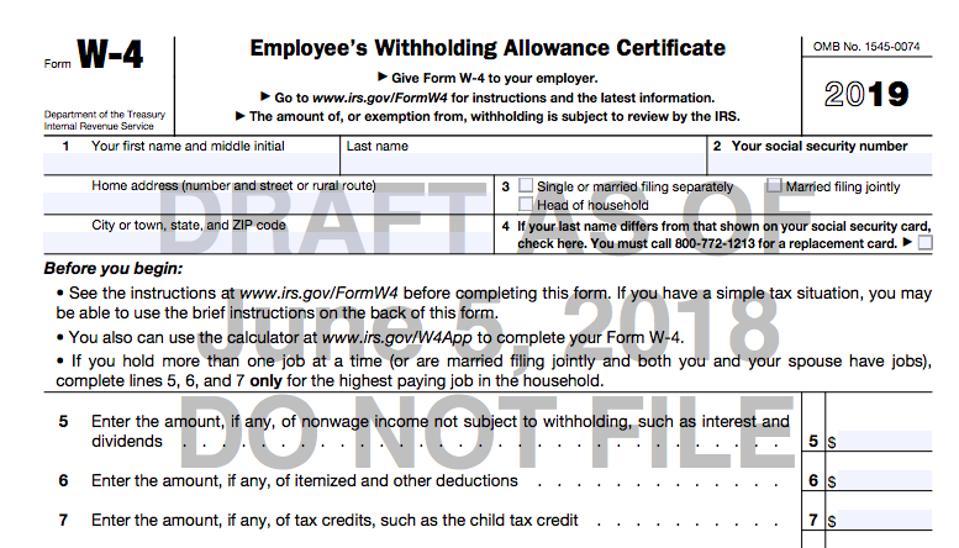

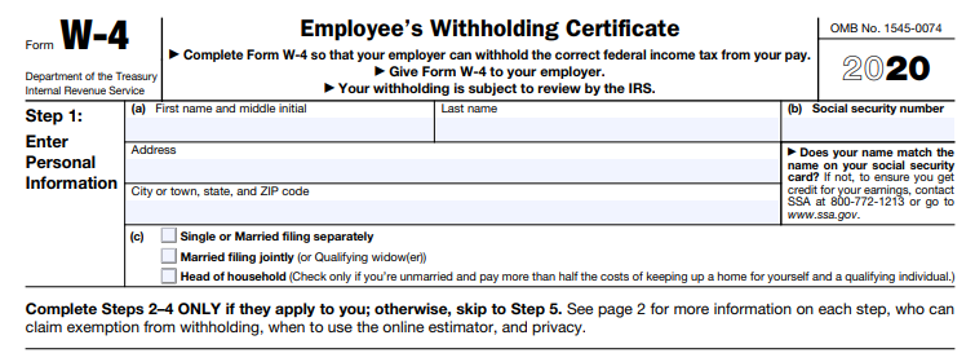

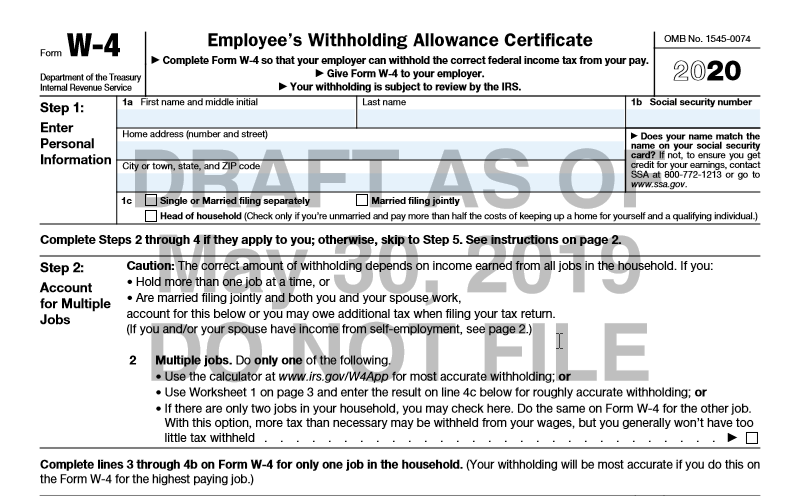

Deductions and adjustments worksheet for federal form w 4 june. Instructions for form 1040 us. That means the information you put on your w 4 directly impacts the size of your paychecks. It helps your employer know how much federal income tax to withhold from your paychecks.

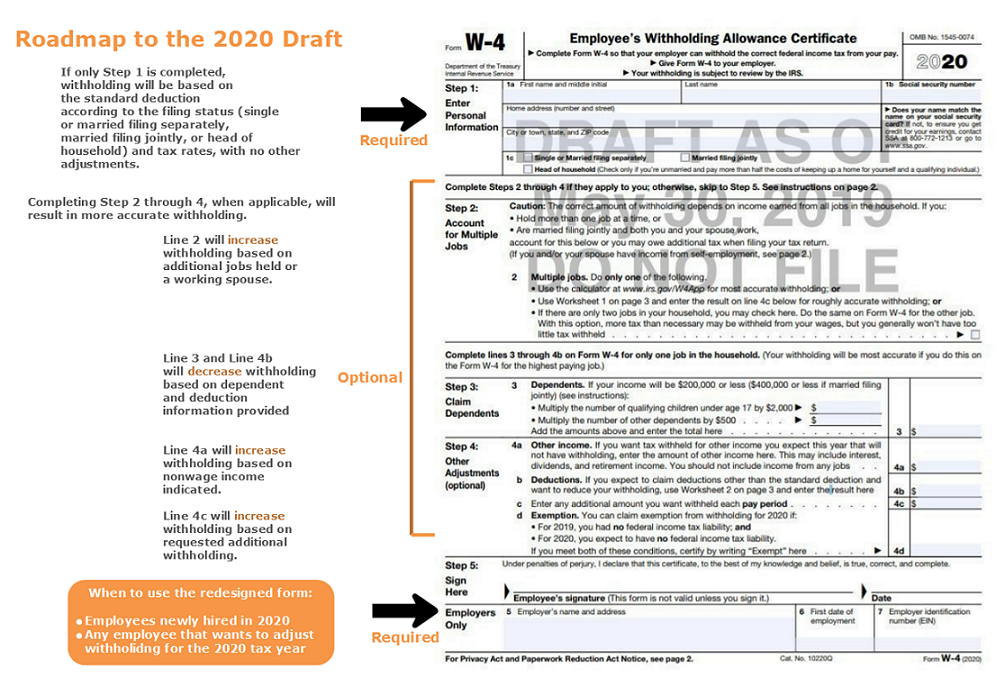

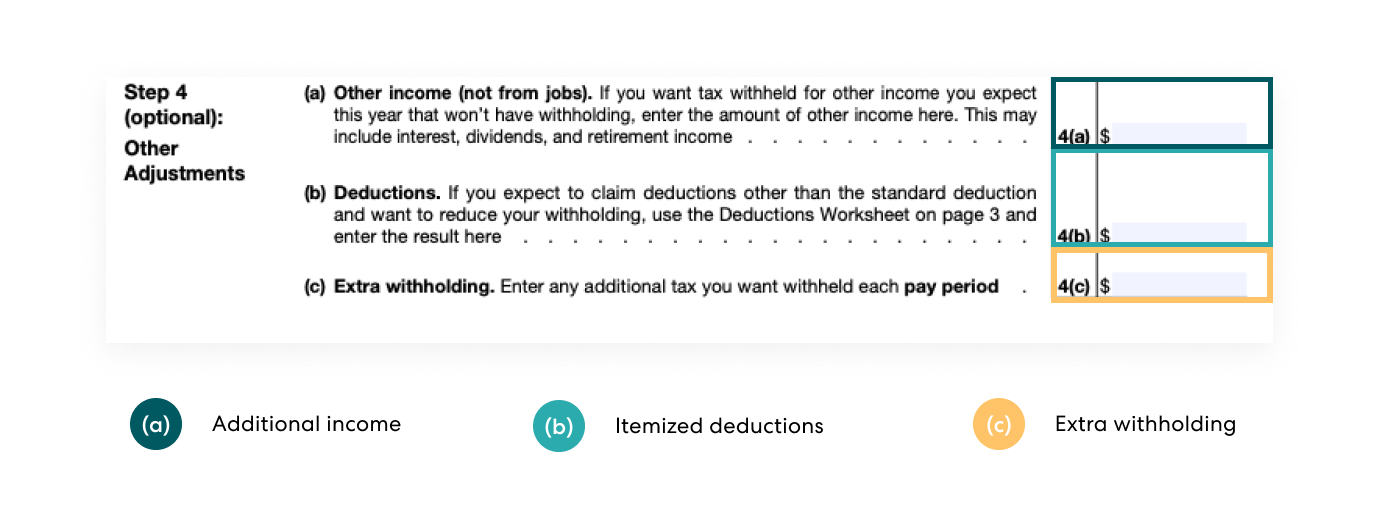

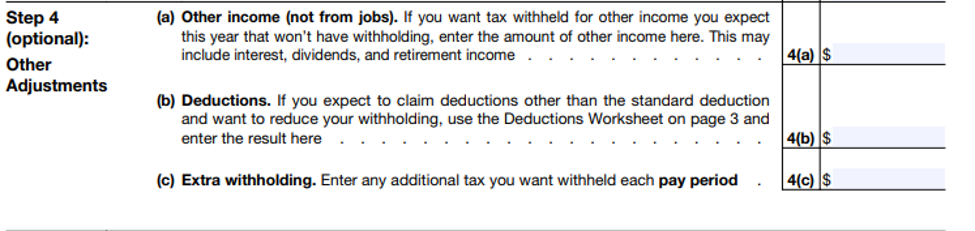

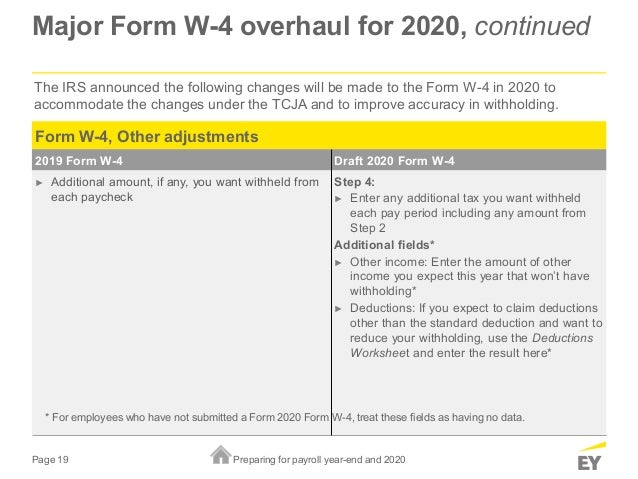

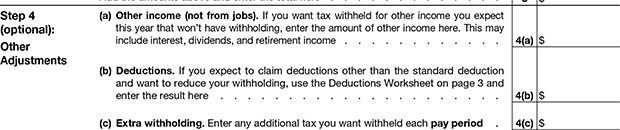

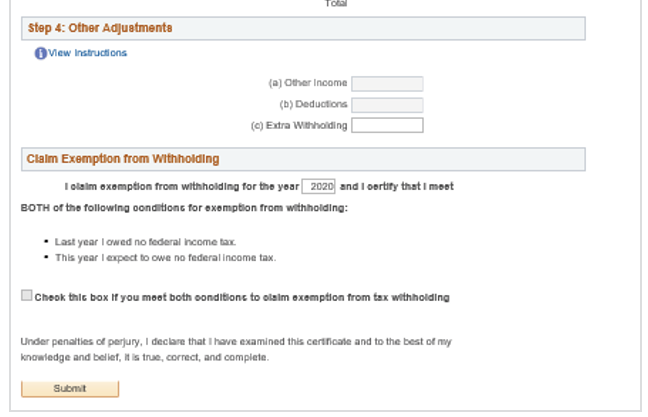

On form w 4 or w 4p. If you expect to claim deductions other than the standard deduction and want to reduce your withholding use the deductions worksheet on page 3 and enter the result here. Adjust your withholding on form w 4 or w 4p.

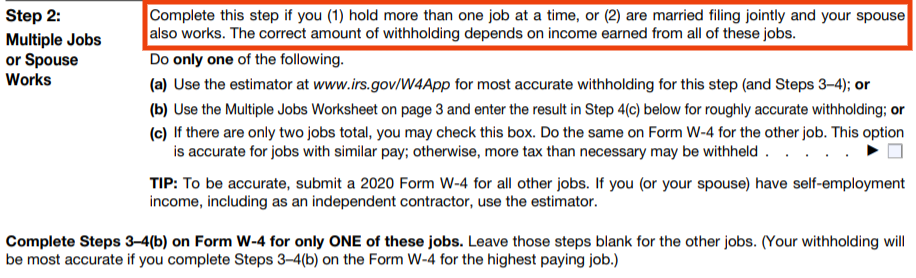

Form w 4 may be completed electronically if your employer has an electronic system. Miscellaneous deductions subject to the 2 agi limit. If you have a working spouse or more than one job figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one form w 4.

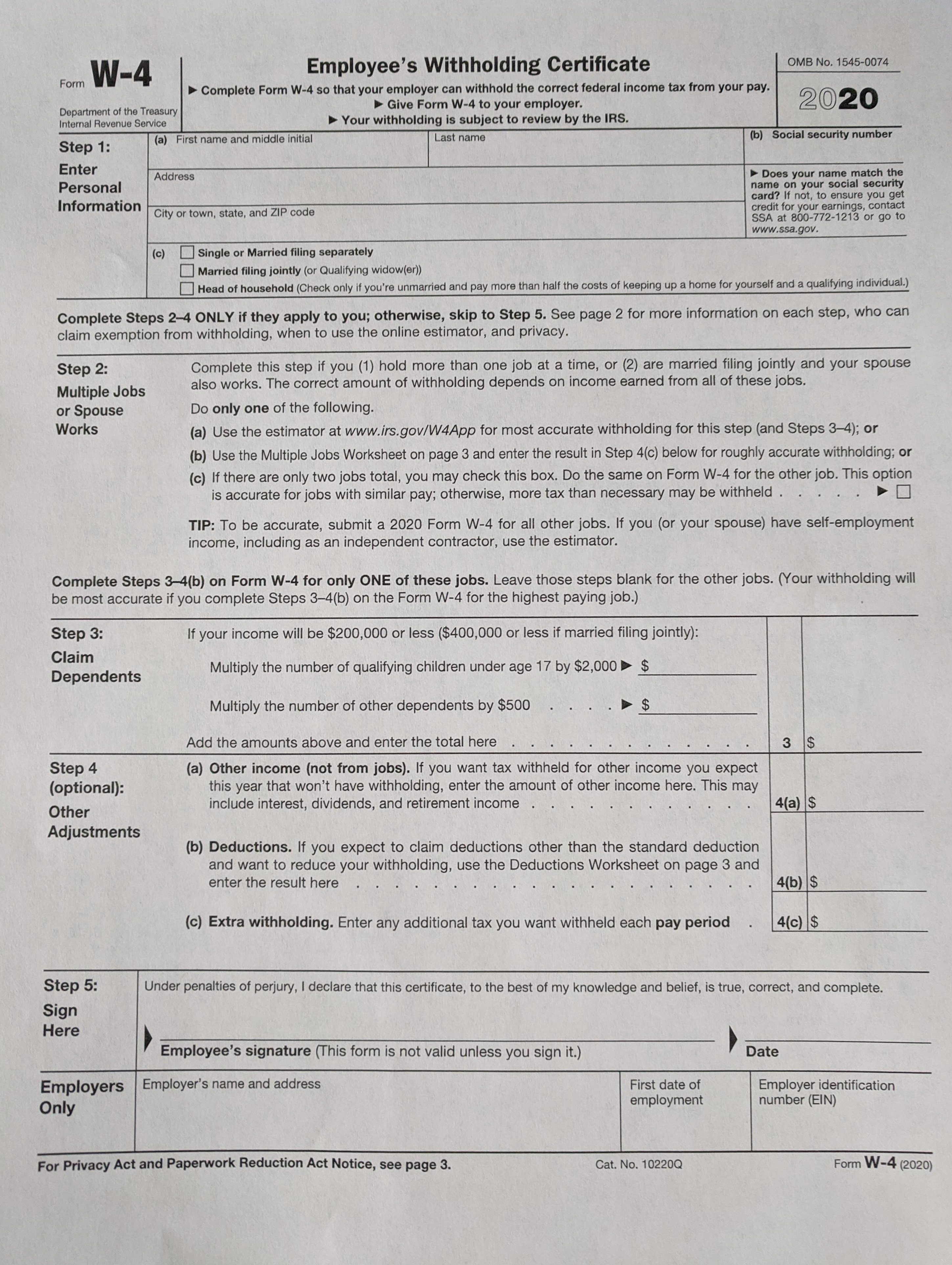

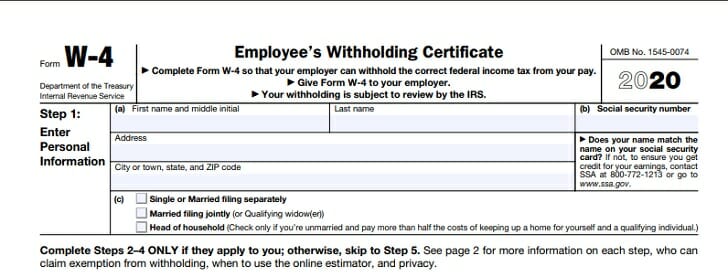

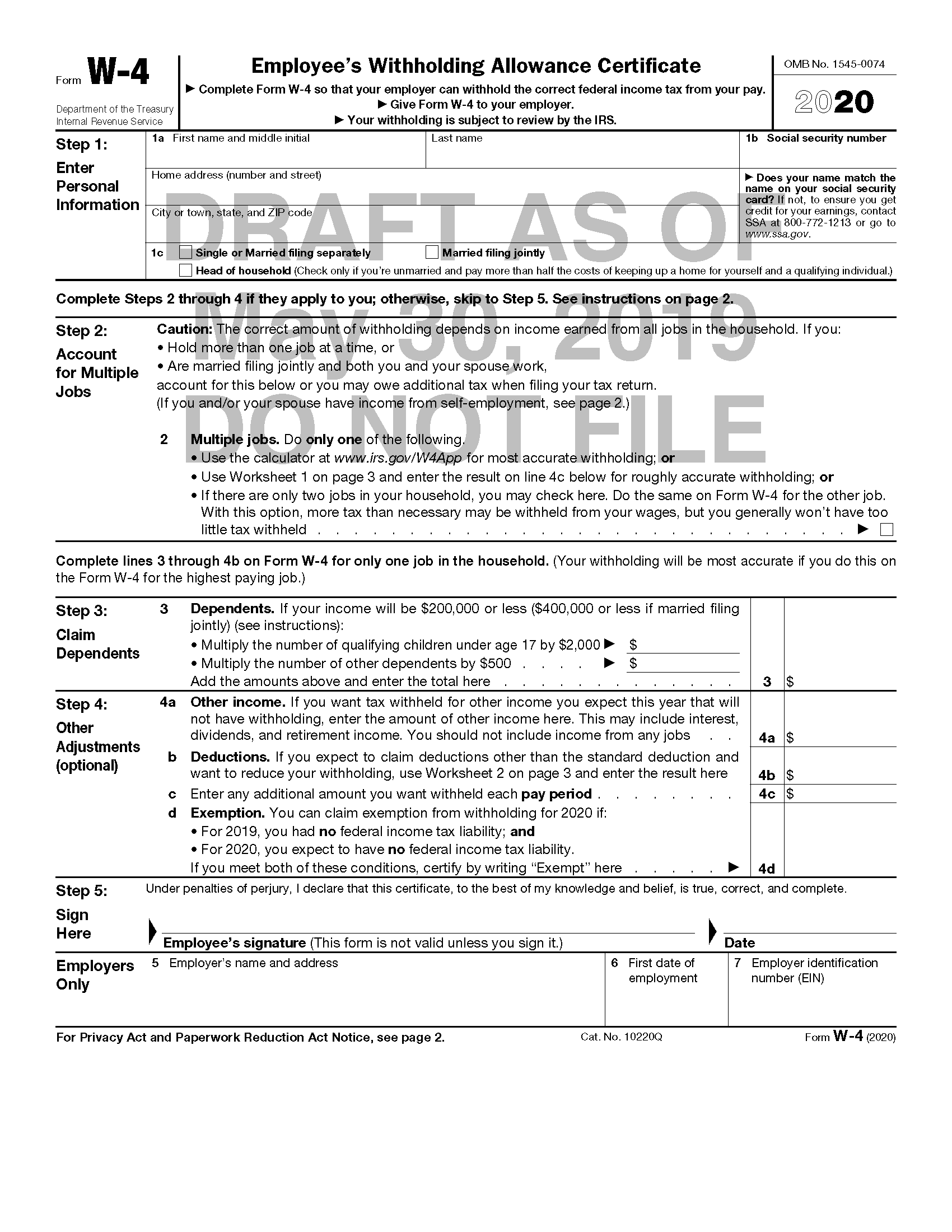

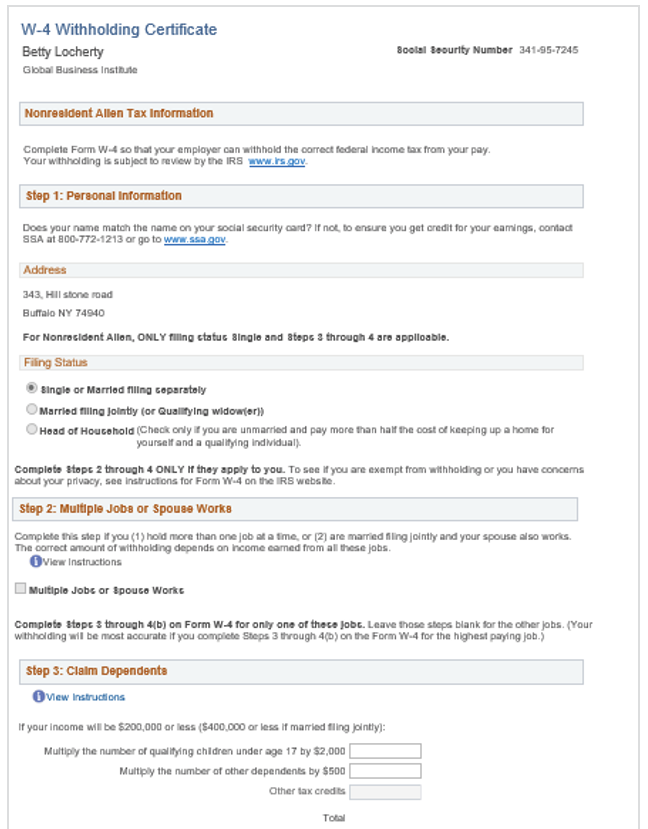

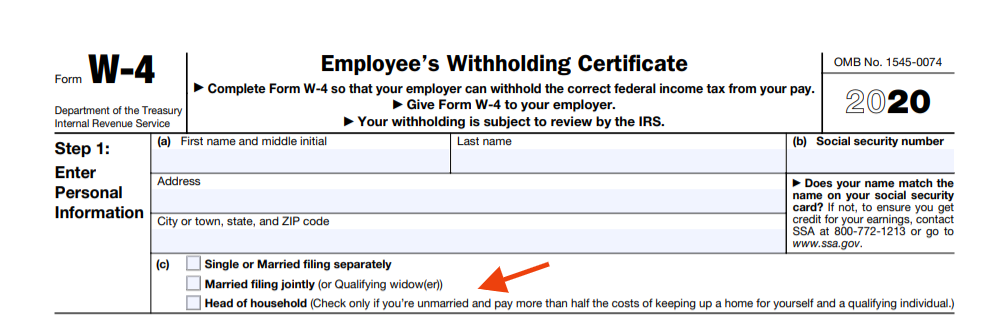

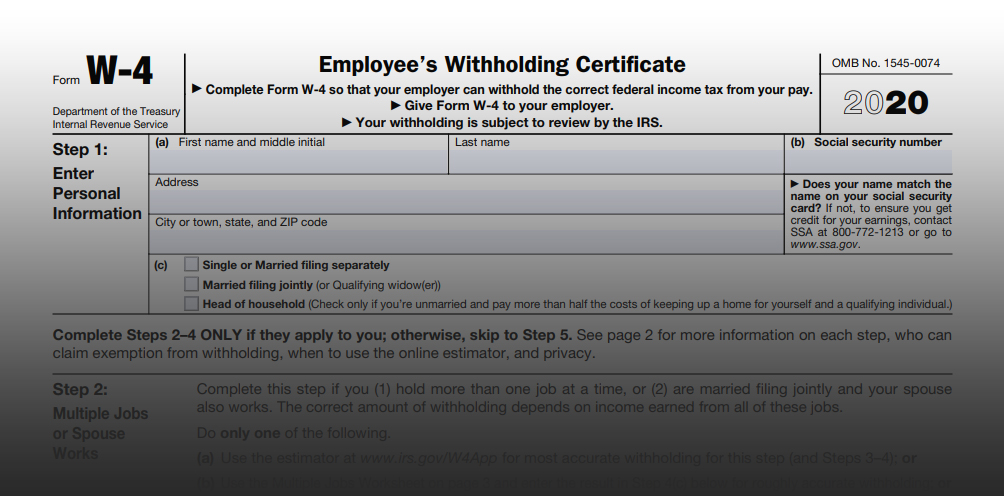

Form w 4 officially titled employees withholding certificate is a common and very important tax form. Step 3 of form w 4 provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return. Complete form w 4 so that your employer can withhold the correct amount of federal income tax from your pay.

Your withholding on form w 4 or w 4p. For example if you are married filing jointly in 2011 your standard deduction equals 11600 so subtract 11600 from 21000 to get 9400. Withholding will be most accurate if you do this on the form w 4 for the highest paying job.

Use the deduction and adjustments worksheet on page 2 of form w 4 if. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. How to get more help with the w 4 allowance worksheet.

1040 schedule 1 instructions line 36 write in adjustments. Complete steps 3 through 4b on only one form w 4. Publication 17 your federal income tax for individuals tax withholding and estimated tax deductions and adjustments worksheet.

If you have a working spouse or more than one job figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one form w 4. Two earners or multiple jobs. Miscellaneous deductions subject to 2 agi.

Qualified business income deduction simplified worksheet. The standard deductions are listed on the deductions and adjustments worksheet. If youre a nonresident alien see notice 1392 supplemental form w 4 instructions for nonresident aliens before completing this form.

Individual income tax return. Sign and date the form. Because your tax situation may change you may want to refigure your withholding each year.

Enter any additional tax you want withheld each pay period. Subtract your standard deduction from the total of your itemized deductions.

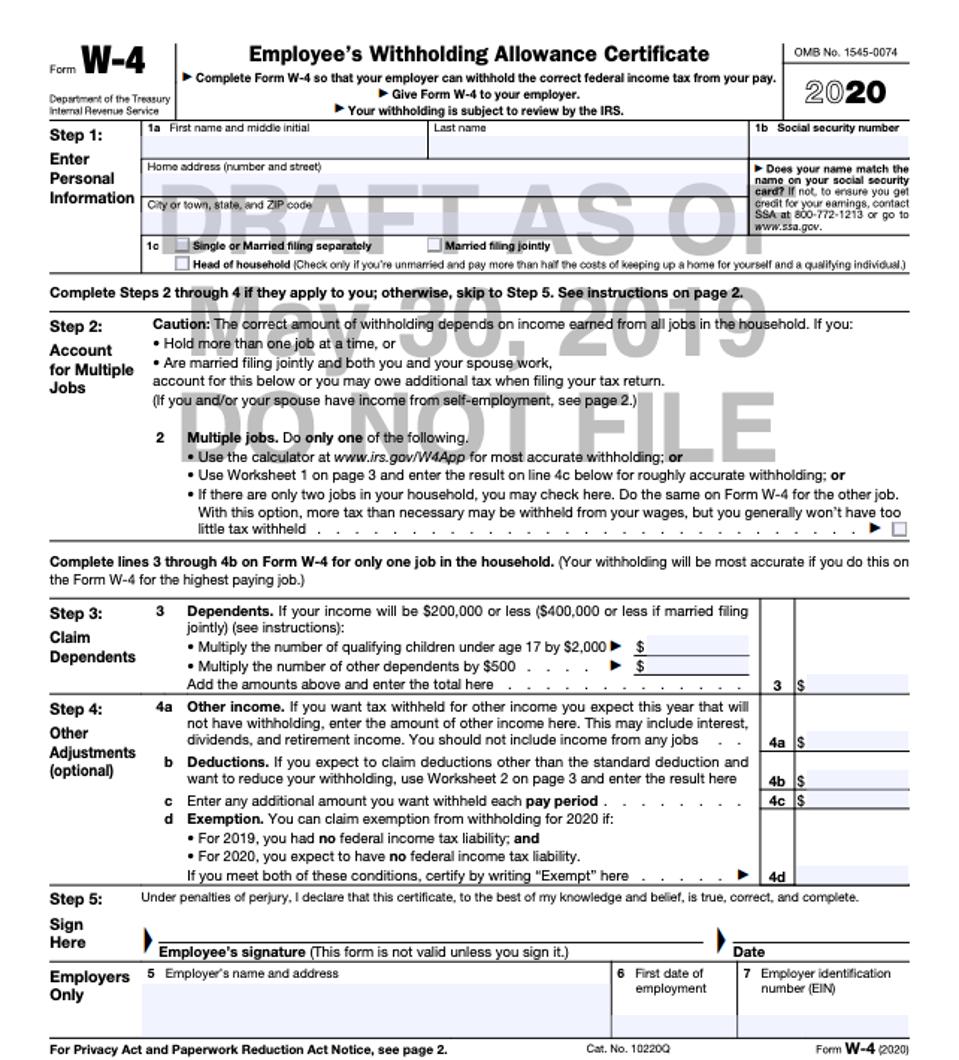

Irs Finalizes New W 4 To Help Taxpayers Correct Withholding Don

How To Fill Out A Form W 4 2020 Edition

How To Fill Out A Form W 4 2020 Edition

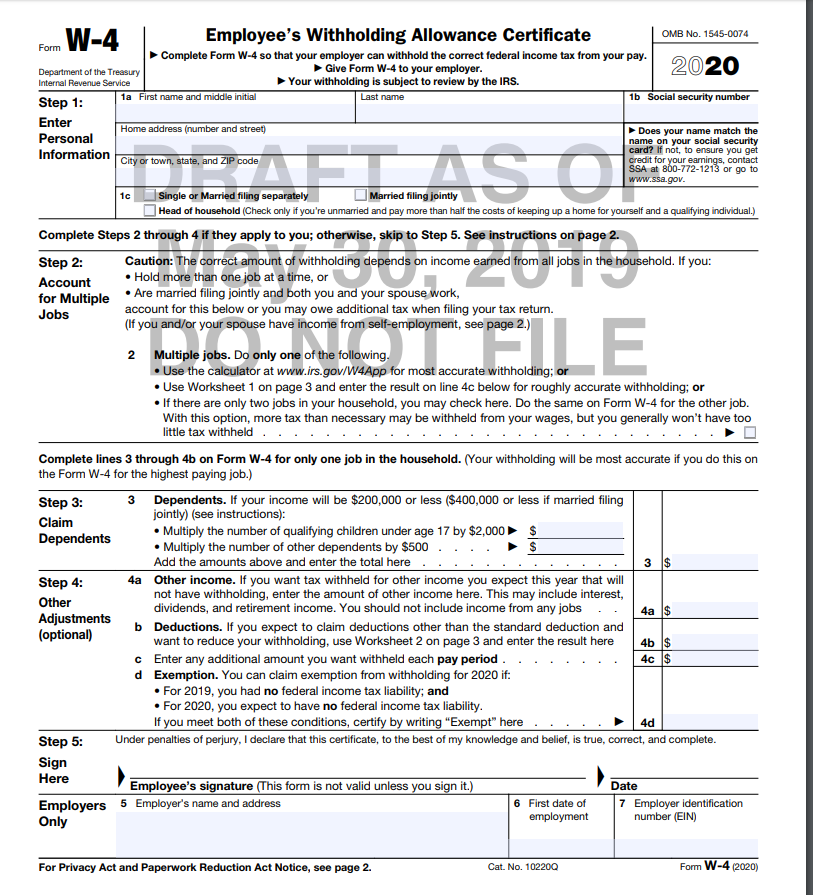

Irs Releases New Draft Form W 4 To Help Taxpayers Avoid

Irs Releases New Draft Form W 4 To Help Taxpayers Avoid

Irs Releases Draft 2020 W 4 Form

Irs Releases Draft 2020 W 4 Form

Irs Issues New W 4 For 2019 Tax Year Withholding Don T Mess With

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Overhauls Form W 4 For 2020 Employee Withholding

Are You Up To Speed On The New For W4 Peoples Income Tax

Are You Up To Speed On The New For W4 Peoples Income Tax

New 2020 Form W 4 Answerline Iowa State University Extension

New 2020 Form W 4 Answerline Iowa State University Extension

Irs Continues To Urge Taxpayers To Doublecheck Their Withholding

Irs Continues To Urge Taxpayers To Doublecheck Their Withholding

Irs W 4 2020 Released What It Means For Employers Tryhris

Irs W 4 2020 Released What It Means For Employers Tryhris

Irs Revises Tax Year 2020 Withholding Form W 4 Yet Again Don T

The New W 4 More Trouble Than It S Worth Accounting Today

The New W 4 More Trouble Than It S Worth Accounting Today

What Is The W 4 Form Here S Your Simple Guide Smartasset

What Is The W 4 Form Here S Your Simple Guide Smartasset

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out And Change Your Form W 4 Withholdings

Irs Releases Draft 2020 W 4 Form

Irs Releases Draft 2020 W 4 Form

Form W 4 Update Delayed Until 2020 Corporate Payroll Services

Form W 4 Update Delayed Until 2020 Corporate Payroll Services

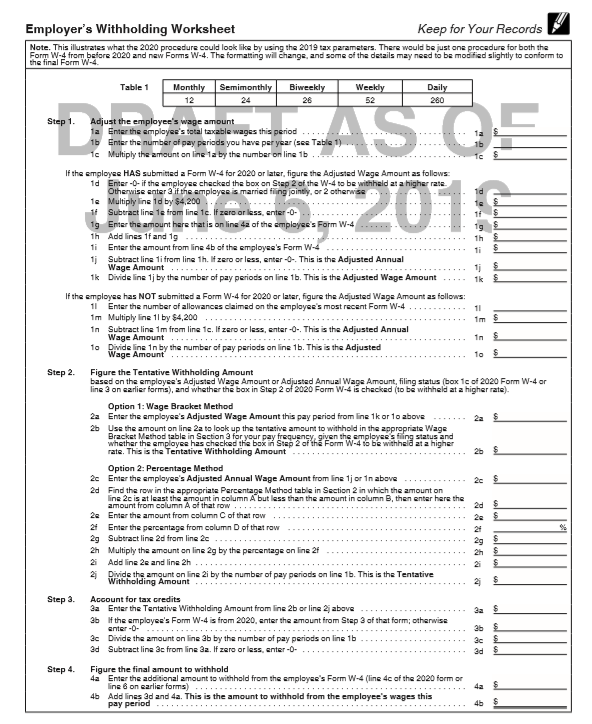

Revised Draft Publication For Computing Withholding By Employers

Revised Draft Publication For Computing Withholding By Employers

New Confusing W 4 Form Is Coming For 2020 What To Do Now

New Confusing W 4 Form Is Coming For 2020 What To Do Now

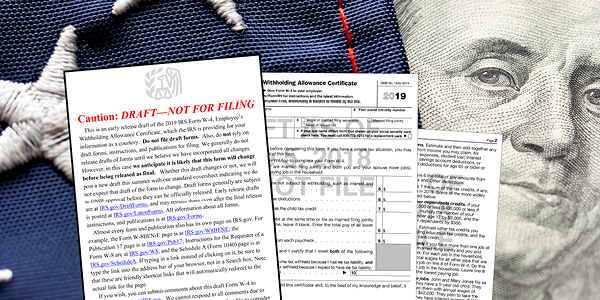

Irs Releases Draft W 4 To Reflect Tax Law Changes Don T Mess

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out And Change Your Form W 4 Withholdings

The New W 4 More Trouble Than It S Worth Accounting Today

The New W 4 More Trouble Than It S Worth Accounting Today

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

Publication 505 2019 Tax Withholding And Estimated Tax

Publication 505 2019 Tax Withholding And Estimated Tax

Estimated Tax Payments Deadline June 17 Cpa Practice Advisor

Estimated Tax Payments Deadline June 17 Cpa Practice Advisor

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

Irs Releases Draft 2019 Form W 4 And Instructions

Irs Releases Draft 2019 Form W 4 And Instructions

New 2020 Form W 4 Released With Many Changes Rkl Llp

New 2020 Form W 4 Released With Many Changes Rkl Llp

/GettyImages-550437717-576840c15f9b58346ae4c7d0.jpg) Reviewing The Withholding Election On Your Irs W 4 Form

Reviewing The Withholding Election On Your Irs W 4 Form

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

The New Irs Form W 4 C2 Essentials Inc

The New Irs Form W 4 C2 Essentials Inc

Publication 970 2019 Tax Benefits For Education Internal

Publication 970 2019 Tax Benefits For Education Internal

Revised Draft Publication For Computing Withholding By Employers

Revised Draft Publication For Computing Withholding By Employers

Employment Forms Packet Floyd Medical Center

Employment Forms Packet Floyd Medical Center

Publication 505 2019 Tax Withholding And Estimated Tax

Publication 505 2019 Tax Withholding And Estimated Tax

Publication 970 2019 Tax Benefits For Education Internal

Publication 970 2019 Tax Benefits For Education Internal

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Overhauls Form W 4 For 2020 Employee Withholding

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out A Form W 4 2020 Edition

How To Fill Out A Form W 4 2020 Edition

Publication 590 A 2019 Contributions To Individual Retirement

Publication 590 A 2019 Contributions To Individual Retirement

Understand W 4 Changes For 2020 Cic Plus

Understand W 4 Changes For 2020 Cic Plus

The New Irs Form W 4 C2 Essentials Inc

The New Irs Form W 4 C2 Essentials Inc

2019 Basics Beyond Tax Blast July 2019 Basics Beyond

2019 Basics Beyond Tax Blast July 2019 Basics Beyond

Tax Prep Dispatch What S Going On With Form W 4 Prosperity Now

Tax Prep Dispatch What S Going On With Form W 4 Prosperity Now

Irs Issues Guidance On Withholding For 2019 Journal Of Accountancy

Irs Issues Guidance On Withholding For 2019 Journal Of Accountancy

The W 4 Paycheck Tax Withholding Form How To Fill It Out

The W 4 Paycheck Tax Withholding Form How To Fill It Out

New 2020 Form W 4 Released With Many Changes Rkl Llp

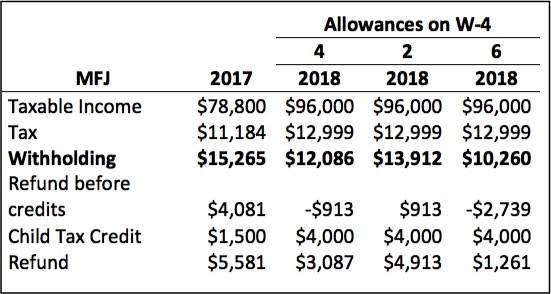

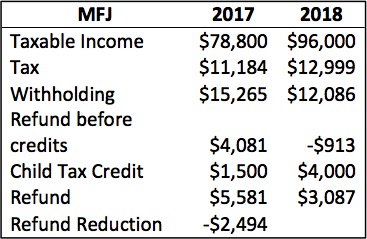

Withholding Under Tax Reform More Than Just A Number Tax Pro

Withholding Under Tax Reform More Than Just A Number Tax Pro

Publication 54 2019 Tax Guide For U S Citizens And Resident

Publication 54 2019 Tax Guide For U S Citizens And Resident

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

![]() The Irs Encourages Postal Employees To Review Their 2019 Federal

The Irs Encourages Postal Employees To Review Their 2019 Federal

Withholding Under Tax Reform More Than Just A Number Tax Pro

Withholding Under Tax Reform More Than Just A Number Tax Pro

Irs Releases An Early Draft Of The 2020 W 4 Integrity Data

Irs Releases An Early Draft Of The 2020 W 4 Integrity Data

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated

Publication 17 2019 Your Federal Income Tax Internal Revenue

Publication 17 2019 Your Federal Income Tax Internal Revenue

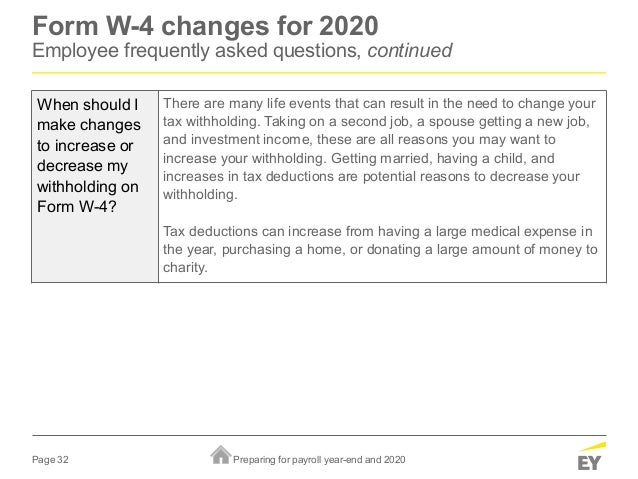

Preparing For Payroll Year End And 2020 12 5 2019

Preparing For Payroll Year End And 2020 12 5 2019

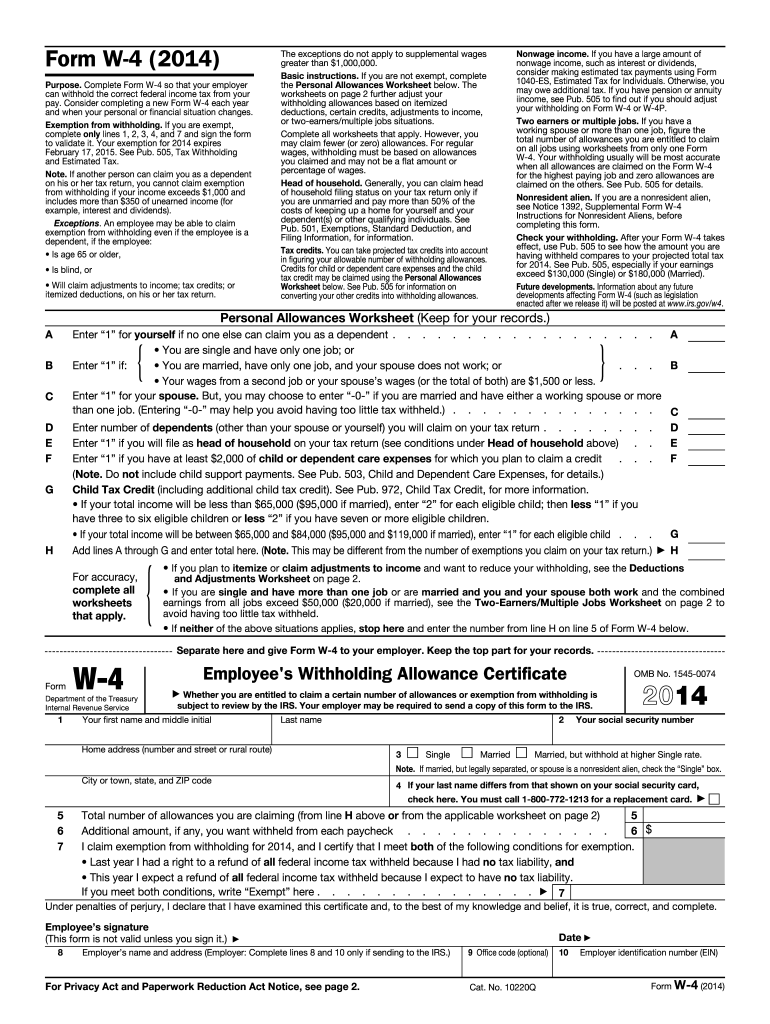

2014 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

2014 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

What Is A W4 Form And How To Fill It Out In 2020 Goco Io

What Is A W4 Form And How To Fill It Out In 2020 Goco Io

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

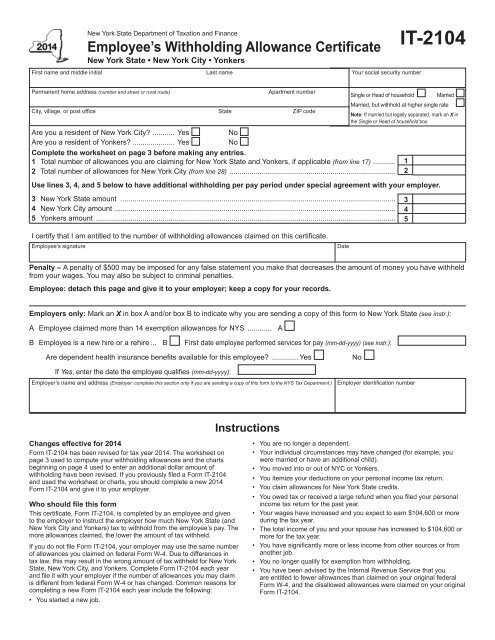

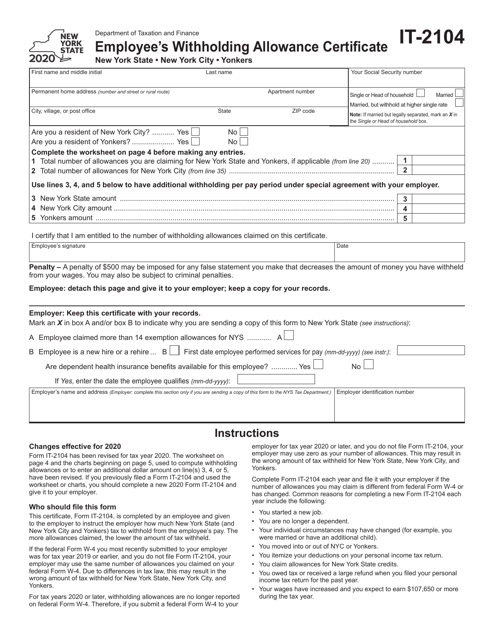

Form It 2104 New York State Tax Withholding South Colonie

Form It 2104 New York State Tax Withholding South Colonie

How To Fill Out A W 4 Form Student Loan Hero

How To Fill Out A W 4 Form Student Loan Hero

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out And Change Your Form W 4 Withholdings

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

New Confusing W 4 Form Is Coming For 2020 What To Do Now

New Confusing W 4 Form Is Coming For 2020 What To Do Now

2020 Form W 4 Now Available In The Employee Portal University Of

2020 Form W 4 Now Available In The Employee Portal University Of

Revised Draft Publication For Computing Withholding By Employers

Revised Draft Publication For Computing Withholding By Employers

The New Irs Form W 4 C2 Essentials Inc

The New Irs Form W 4 C2 Essentials Inc

2019 Basics Beyond Tax Blast July 2019 Basics Beyond

2019 Basics Beyond Tax Blast July 2019 Basics Beyond

Preparing For Payroll Year End And 2020 12 5 2019

Preparing For Payroll Year End And 2020 12 5 2019

Taxes Here S Why You Should Fill Out The New W 4 Form Cnnpolitics

Taxes Here S Why You Should Fill Out The New W 4 Form Cnnpolitics

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

The New Form W 4 Withholding In 2020 Have Changed For Business Owners

Tax Forms Irs Tax Forms Bankrate Com

Tax Forms Irs Tax Forms Bankrate Com

Irs Releases Draft Instructions For 2020 Income Tax Withholding

Irs Releases Draft Instructions For 2020 Income Tax Withholding

Irs Releases Draft 2020 W 4 Form

Irs Releases Draft 2020 W 4 Form

2018 2020 Form Nj Dot Nj W4 Fill Online Printable Fillable

2018 2020 Form Nj Dot Nj W4 Fill Online Printable Fillable

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs Expands 2020 Draft Withholding Calculation Publication

Irs Expands 2020 Draft Withholding Calculation Publication

Irs Continues To Urge Taxpayers To Doublecheck Their Withholding

Irs Continues To Urge Taxpayers To Doublecheck Their Withholding

Claiming Exemptions The W 4 For Dummies Robergtaxsolutions Com

Form It 2104 Download Fillable Pdf Or Fill Online Employee S

Form It 2104 Download Fillable Pdf Or Fill Online Employee S

2019 Instructions For Schedule H 2019 Internal Revenue Service

2019 Instructions For Schedule H 2019 Internal Revenue Service

Irs Issues New W 4 For 2019 Tax Year Withholding Don T Mess With

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

How To Fill Out Form W 4 In 2020 Adjusting Your Paycheck Tax

What Is A W4 Form And Benefits Of Having It Signed Online

What Is A W4 Form And Benefits Of Having It Signed Online

2020 Form W 4 Now Available In The Employee Portal University Of

2020 Form W 4 Now Available In The Employee Portal University Of

How To Determine Your W 4 Allowances Priortax

How To Determine Your W 4 Allowances Priortax

The 2018 Irs Form W 4 Has Been Released Now What Should Employers

The 2018 Irs Form W 4 Has Been Released Now What Should Employers

Differences In Claiming Single Or Married On A W 4

Differences In Claiming Single Or Married On A W 4

W 4 Calculations Don T Have To Be A Black Box Evolving Personal

Https Www Gao Gov Assets 700 693582 Pdf

Understand W 4 Changes For 2020 Cic Plus

Understand W 4 Changes For 2020 Cic Plus

Withholding Under Tax Reform More Than Just A Number Tax Pro

Withholding Under Tax Reform More Than Just A Number Tax Pro

The 2020 W 4 Paycheck Tax Withholding Calculator

The 2020 W 4 Paycheck Tax Withholding Calculator

Thanks for providing me that sensational information which will surely increase my knowledge and prove it quite helpful

ReplyDelete